Credit score plays a very important role in getting loans, credit cards, and other financial products in the UAE. Fortunately, you can check your credit score online from anywhere, whether you’re making a financial decision or just assessing your financial situation. Additionally, understanding your credit score is crucial for effective financial planning, as it can impact interest rates and loan approvals. Various financial planning tools in UAE can help you track and improve your creditworthiness over time. By leveraging these resources, you can make informed decisions that align with your financial goals.

Credit score is an important part of your financial future and you need to know it so that you can see your financial situation and make financial decisions.

Checking your credit score will make it easier for you to manage your finances better. Here we are going to tell you complete details and methods to check credit score in UAE. Understanding your credit score can also open up a variety of banking options for expats in UAE, making it easier to secure loans and credit cards with favorable terms. Additionally, many banks offer tailored financial products that can help you build a strong credit history while living abroad. By regularly monitoring your score, you’ll be better equipped to take advantage of these opportunities and achieve your financial goals. Moreover, maintaining a good credit score can also enable you to access services that facilitate everyday transactions, such as knowing how to open a du pay account. This knowledge can streamline your financial activities and ensure you have a reliable means of managing essential payments. Ultimately, being proactive about your credit score empowers you to make informed financial decisions while living in the UAE.

What is a Credit Score in the UAE?

A credit score is a financial number that reflects your financial standing. Credit scores in the UAE are primarily used by banks and financial institutions to assess whether you will be able to repay a loan once you get it. The better your credit score, the easier it is to borrow money and the lower the interest rate. A good credit score can also open up opportunities for you to obtain credit cards with better benefits and higher limits. Additionally, it’s important to stay informed about any updates in financial policies, such as the emirates nbd remittance fee changes, as these can impact your overall financial health and borrowing capacity. Regularly monitoring your credit score and understanding how it’s influenced by your financial decisions can help you maintain or improve your creditworthiness.

In the United Arab Emirates, the Credit Bureau (AECB) provides credit score details. This agency collects information from a variety of financial institutions and compiles your credit score in one place. This includes banks, credit card companies, and other lenders. If we put it in simple words, it shows your financial reputation. Maintaining a good credit score is essential for securing loans and favorable interest rates. For those looking to improve their financial standing, one effective step is to open salary account with emirates nbd, which can help in building a positive credit history. By regularly managing your account and making timely payments, you can enhance your overall creditworthiness.

Also read: How to Get Salary Certificate in UAE

What Is A Good Credit Score?

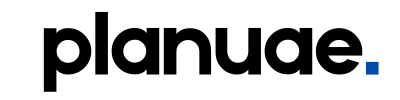

A good credit score reflects your strong financial standing, usually above 700. A credit score in the United Arab Emirates ranges from 300 to 900, with a score of 700 or above considered very good. A CRATE score between 800 and 900 is considered excellent and can get you a bigger loan and a lower interest rate. To understand the credit score we provide you information in a table so that you can get better guidance. Additionally, maintaining a good credit score can significantly impact your purchasing power, especially when considering major investments like real estate or vehicles. It’s also worth noting how external factors, such as economic conditions or gold prices in UAE today, can influence your overall financial stability. Keeping an eye on these variables can help you make informed decisions that align with your financial goals.

| Credit Score | Rating | Description |

|---|---|---|

| 300 – 579 | Poor | It may be difficult to obtain credit with this score. |

| 580 – 669 | Fair | Credit can be obtained, but interest rates may be higher. |

| 670 – 739 | Good | Credit is obtainable with favorable terms. |

| 740 – 799 | Very Good | Access to credit with lower interest rates is available. |

| 800 – 900 | Excellent | Best terms and lowest interest rates on financial products. |

This table helps in understanding how different credit score ranges affect your ability to secure credit and the terms you might receive. Higher credit scores generally lead to more favorable loan terms, such as lower interest rates and higher credit limits, while lower scores may result in higher costs or a denial of credit altogether. It’s also important to stay informed about your financial standing by regularly checking your credit reports and scores. Additionally, understanding how to check ratibi card balance can help you manage your finances more effectively and ensure you remain within your credit limits.

How Is My UAE Credit Score Calculated?

Various factors are taken into account to calculate a credit score including:

- Payment History: How you’ve been paying off loans, credit cards, and other financial obligations is the most important factor. Paying on time improves your score while paying late lowers your score.

- Amount of Debt: A high loan amount or high amount of borrowing also affects your credit score.

- Credit History Length: Credit history is very important because the longer it is, the easier it is to understand. A long credit history is considered better because it shows that you have managed financial obligations for a long time.

- New Credit Applications: Repeated applications show that your financial situation is unstable.

- Types of Credit Used: Using different types of credit (such as loans, credit cards, and home loans) can have a positive impact on your score. It shows that you can handle responsibilities well.

- Economic Conditions: Domestic and global economic conditions can also affect your credit score – if your country’s financial conditions are not good or you are unemployed, your score may still be low.

How Can I Check My UAE Credit Score?

You can check Credit score in UAE using the AECB website, app and by going to their branches. Provide your Emirates ID and get the complete report. When you want to get a statement of your credit score, you have to pay a fee starting from 10.50 AED. Here are the step-by-step instructions on how to do that. Additionally, while you’re managing your financial health, you might also want to know how to check insurance status to ensure you’re adequately covered. This information can typically be found on your insurance provider’s website or by contacting their customer service. Keeping both your credit score and insurance status up to date is crucial for informed financial decisions. Furthermore, understanding the importance of maintaining your financial status extends beyond just credit scores and insurance. For example, comprehending what is kyc in uae is essential for ensuring compliance with local financial regulations and enhancing your overall financial security. By staying informed about KYC procedures, you can better protect yourself against potential fraud and streamline your banking and investment processes.

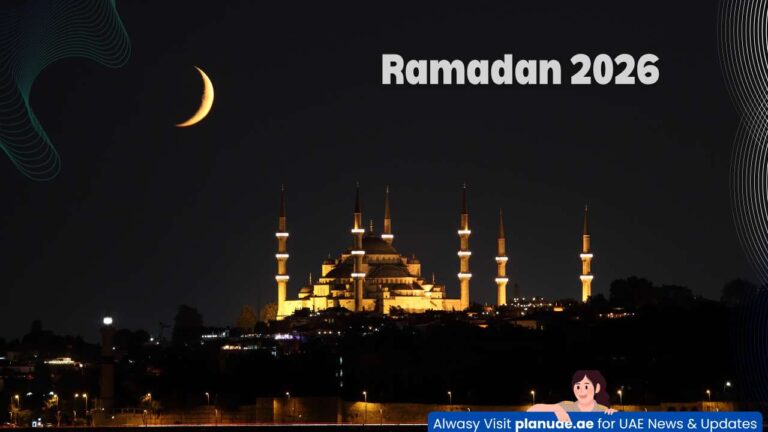

1. Check Credit Score Through The AECB Website

There is an easy procedure to check your credit score in UAE on the website of “Etihad Credit Bureau” (AECB). You can check your credit score by sitting anywhere. Additionally, the website provides a user-friendly interface that guides you through the process step-by-step. Along with managing your credit, you can also find resources on how to check hafilat card balance, ensuring you stay informed about all your financial obligations. This convenient access to information empowers you to maintain better control over your finances. Moreover, the AECB website also offers tools to help users monitor their various financial accounts effectively. For instance, you can easily access information on your al ansari salary card balance, allowing you to keep track of your earnings and expenditures in real time. Staying updated on these details can significantly enhance your budgeting and financial planning efforts.

- Step 1: visit the official AECB website at etihadbureau.ae

- Step 2:If you are an individual, then select “Individual” and companies select “For Company“

- Step 3: Now, click on “Get a Credit Report Now”.

- Step 4: You will be redirected to the login page where you must enter login details if you have an account. You can also use UAE Pass to log in and create an account quickly.

- Step 5:Select the “Get Report”

- Step 6:Pay the Fee and download the credit report.

2. Check Credit Score Through The AECB App

Here is the quick guide to check Credit score using the AECB app:

- Download and Install the AECB app for iOS and Google Play Store.

- Login to your account by scanning your Emirates ID

- Tap on “Get Credit Report” and wait

- Pay the fee and then download the report

3. Check your UAE Credit Score Through The AECB Branches

Find the AECB branches near you by searching “AECB branch near me” on Google. Before this. take all necessary documents such as Emirates ID, passport copy, and email address.

Ask the staff to check your credit score at the branch. Submit the documents, and in no time they will provide you with a report for which the fee may vary. Additionally, you can inquire about other services they offer, such as a lulu salary card balance check, to help you manage your finances more effectively. Understanding your credit score and keeping track of your salary balance can provide valuable insights into your financial health. Be sure to ask for any tips on improving your score while you’re there. In addition to monitoring your credit score, it’s also wise to explore the salary card benefits in ras al khaimah that could enhance your financial management. These services may include better tracking of your income, lower fees on transactions, and even exclusive discounts at certain retailers. By utilizing these benefits, you can optimize your spending and savings strategy, ultimately leading to improved financial stability.

Cost of Checking Your Credit Score in UAE

You may have to pay a credit check fee on the AECB website, which may vary from just viewing the score and getting the report. But generally, this fee can range from AED 100 to AED 150. Additionally, it’s important to be aware that many financial institutions in the UAE have recently implemented changes regarding their services. As part of these changes, some banks are considering a uae banks minimum balance increase, which might impact your account management. Staying informed about these updates can help you better navigate your finances and avoid unexpected fees. Moreover, due to the recent UAE Central Bank AML crackdown, banks are tightening their compliance measures, which may lead to more stringent requirements for account holders. This could mean increased documentation and verification processes, making it essential to keep your financial records organized and up-to-date. Understanding these evolving regulations can empower you to maintain smoother financial transactions.

Sometimes you can also buy an annual subscription plan from AECB which usually costs between AED 200 to AED 300. There is fee information for both individuals and businesses. This subscription provides access to a comprehensive range of financial services and tools, allowing users to make informed decisions. Additionally, it can be particularly useful for those exploring alternative investment options in UAE, offering valuable insights into market trends and opportunities. Members often benefit from exclusive reports and resources designed to enhance their investment strategies.

For Companies

| TYPE | Website Fee | Branch Fee |

|---|---|---|

| Credit Score | 10.50 AED | 21 AED |

| Credit Score with Report | 157.50 AED | 189 AED |

For Individuals

| TYPE | Website Fee | Branch Fee |

|---|---|---|

| Credit Score | 10.50 AED | 21 AED |

| Credit Score with Report | 84 AED | 105 AED |

Why is a Good Credit Score Important?

A good credit score plays a very important role in financial life as it makes it easier to get loans, credit cards, and other financial services. Having a good credit score allows lenders to provide loans quickly and as per your requirements without much investigation. Here are some more benefits and reasons why a good credit score is important.

- You can easily get a loan as per your requirement

- A higher credit score provides lower interest rates

- You can borrow more to better manage expenses or emergencies.

- This can make it easier for you to get a job.

- With a good credit score, you can easily get anything on a rental property, or installments

Understanding Your Credit Report

When you get your credit report, it is based on a variety of factors. It contains everything you did to use the money or show your financial behavior. Whether you took a loan from somewhere, paid a bill for anything, or borrowed something in installments, every single check is recorded here. With this report, you can also understand why your credit score is low and you can fix it.

Also read: How to Check Emirates ID Status Online

Key Elements of Your Credit Report

- Personal Information:

This section contains your personal details, such as your full name, address, date of birth, and identification number (such as Emirates ID, passport number), etc. - Credit Accounts:

Contains your credit information such as credit cards, loans, and mortgages with full details such as account type, date opened, credit limit or loan amount, current balance, and payment date. - Payment history:

Payment history is an important part of your credit score and plays a very important role. In this section, you will find all the information about what type of payment has increased or decreased your credit score. - Account Status:

This section contains all your account information, which account is active and which is closed, fully paid or defaulted. - Duration of Credit History:

This indicates how long your credit accounts have been active. A longer period usually gives a positive score.

How to Get a Credit Report

The best option is to get the report through the Credit Bureau (AECB) website. There are some more options like using the app, visiting the AECB branch. Using the AECB website, you can get the report while setting at home without any hassle. Just follow the quick instructions. Additionally, if you’re looking to manage your finances effectively, consider exploring ppc fab bank balance methods that can help you track your expenses and savings. These strategies can complement the insights you gain from your credit report, enabling you to make informed decisions regarding your financial health. With the right tools at your disposal, achieving your financial goals becomes much more attainable. Moreover, if you are a customer of certain banks, you might also want to familiarize yourself with the rpay balance inquiry process, which can offer you real-time insights into your account balances. Understanding these processes allows for better control over your finances, as you can quickly check your available funds and plan your expenditures accordingly. Implementing such tools alongside regular credit report reviews will empower you to manage your financial landscape more effectively.

AECB Website:

- Visit the official website etihadbureau.ae/.

- Select the “Individual” or “For business,” and click on the “get credit report” button

- Enter the login details

- Create an account using the UAE Pass or your personal information like Email, number, Emirates ID, age, and account type.

- Verify your identity

- Once the account is created, log in to your account.

- Request your credit report and select the report type like “Summary” and “detailed report”.

- Pay the fee using Google Pay or your account debit card

- Download the report and review it.

Read More: Delete UAE Pass Account | Check Credit Score in UAE | Check Emirates ID Status

Requirements for Checking Your Credit Score

Checking the credit score for individuals and companies has different requirements. In order to check the credit score, you will need the following documents.

Requirements for Companies: Original Emirates ID, Email address, and a Passport copy

Requirements for Individuals: Authorized Letter, Valid Trade License, Bank’s Authorized Signatory and a Valid Email Address.

Tips on How To Improve Credit Scores in UAE

If your UAE credit score is low and you want to improve this, don’t worry, read these tips.

- Make timely payments: A lot of your credit score depends on your payment history. When you make all your loan, bill, and credit card payments on time, your score will be positive.

- Keep credit card balances low: Keep your credit balances low and use less than 30% of your credit limit. One thing to remember is that low credit utilization can improve your score.

- Maintain Old Credit History: Try not to close your old credit accounts as an old credit record can create a good score for you. Don’t even take out a new credit card or take out a loan out of necessity as this can temporarily affect your score.

- Prioritize loan payments: Make your loan payments on time and make them a high priority. Making early payments can improve your score.

Common Misconceptions About Credit Scores

There are many misconceptions people have about credit scores, which make it difficult for them to make financial decisions. These misconceptions make it difficult for people to understand the credit score and get it right. Here are some misconceptions that you must understand.

Does checking a credit score lower a score?

Many people believe that doing a credit score check will lower their score. This is a misconception and does not affect your credit. But yes, if a financial institution checks your credit record, called a “hard inquiry” it can have some impact on your credit.

By not using a credit card, the credit score improves.

Many people believe that if they don’t use a credit card, their score will improve. However, not using a credit card reduces the credit history, which can negatively affect the score. When you use the credit card regularly, you will get a positive score.

Does credit score only matter for loans?

Many people believe that taking out a loan improves their credit score. However, it actually depends on various factors, especially your financial decisions.

Can a once-bad score never be fixed?

It has also been observed in people that they think that once a credit score is bad, it is not fixed. This is their misunderstanding. Even if one has a bad score, making regular and timely payments, using less debt, and maintaining a good credit history can improve the score.

Summary

Checking credit score is a very easy task, and paying attention to it can also give you a lot of benefits. You can improve your credit score by paying your debts, bills, and other amounts on time. A company or an individual can easily check it online with some fees.

Any kind of financial decision affects your score and this score plays a very important role in your financial life. Hope you have got complete information about its benefits and some misconceptions. If you face any problem, you can ask in the comments.