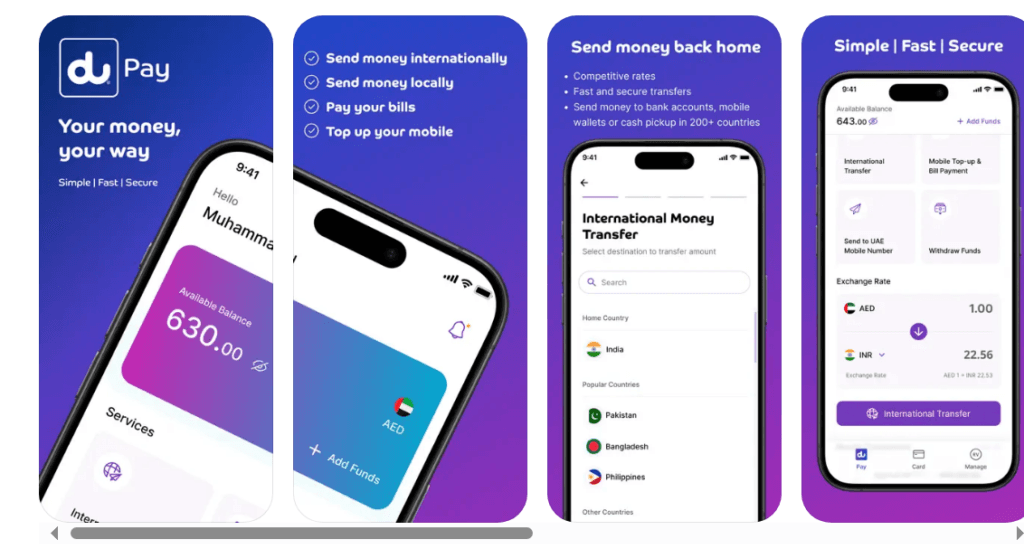

du Pay is a digital wallet app offered by du in the United Arab Emirates that works like a bank app. If you are unable to open a bank account in the United Arab Emirates, you can open a du Pay account quickly and easily from the comfort of your home. With this account, you can save money, pay bills, and send and receive money in more than 200 countries. Apart from this, duPay has many features like prepaid recharge, postpaid bill payment, tax payment government fee accrual, etc. In this article, we will learn how to create a du Pay account, the requirements, and its limits.

Benefits of creating a du account:

- You can open it on any mobile network.

- There is no need for any kind of salary show-off.

- Open an account using the du Pay app quickly just using your Emirates ID

- Can send money to more than 200 countries

- Mobile recharge facility

- Modern Bill Payment Facility

- Paying government fees or taxes

- Shopping online

- You can use A physical credit card to withdraw money anywhere or shop online.

Also read: RPay Balance Enquiry

How to Open a Du Pay Bank Account Online in UAE?

You can follow the steps below to create a du Pay account:

1. Download and Install the du Pay app:

- First, you need to download and install the du Pay app. This app is available via Google Play Store or Apple Store.

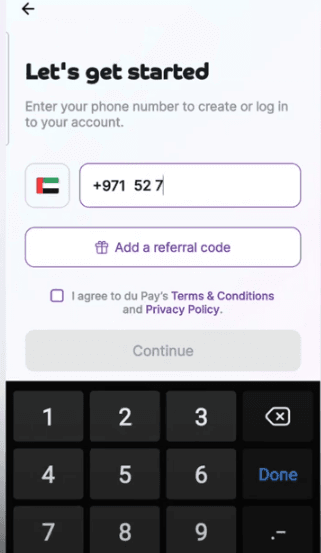

2. Register a new account

- Open the app, and go next to all the cards or options until the option to enter the mobile number appears in front of you.

- Enter your mobile number:

- In this step, you need to enter any mobile number of yours whether it is DU, Etisalat, or Virgin mobile network. Check the terms and conditions and click “Continue”.

One thing to remember is that this number should be registered in your name so that you don’t face any kind of problem later.

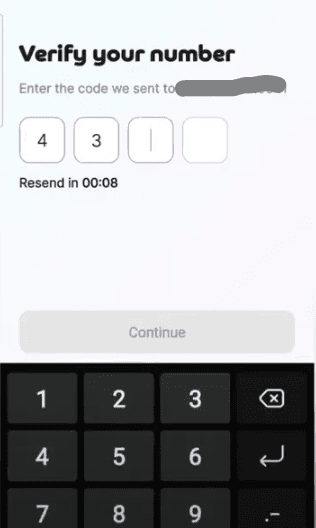

3. Verify your Number

- Verify your number by entering the received 4-digit OTP in the app. Click or tap on the “Continue” button.

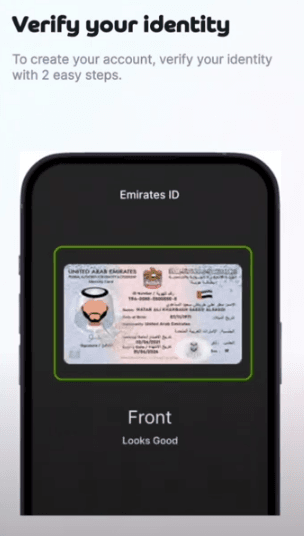

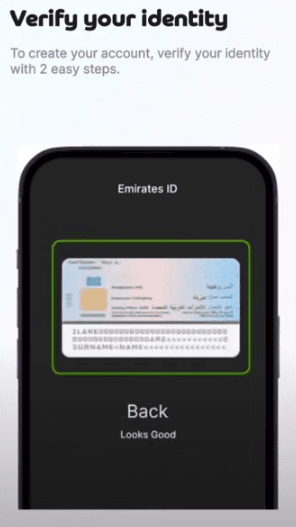

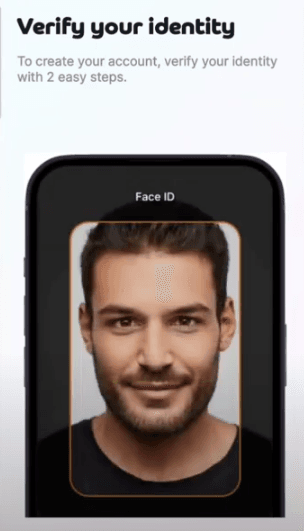

4. Verify your Identity

Now you will need verification for which you must have an Emirates ID.

- In the first step, you have to upload your Emirates ID front site.

- In the second step, you have to upload the back side.

- In the third step, du Pay will ask you for a selfie or live verification. Here you have to take your live selfie and verify it.

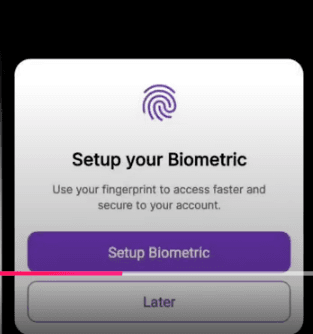

5. Setting Up Biomatric or PIN

After all the verification is done, DUPay will give you the option to set a PIN or lock your biometric. Click “Setup Biometric” if you want to set it up or click “Later” to skip it.

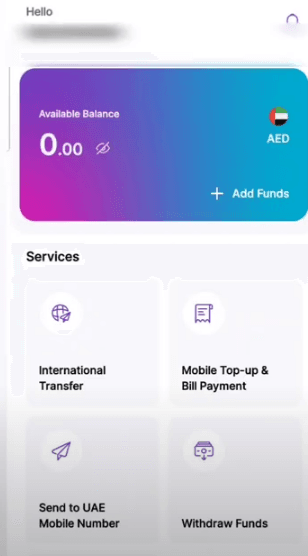

6. Start Using du Pay

Now your account is created and you can use it to send, receive, pay bills, and many other things. To transfer money to du Pay, you can transfer money from any nearby inward bank transfer or via a network of payment machines.

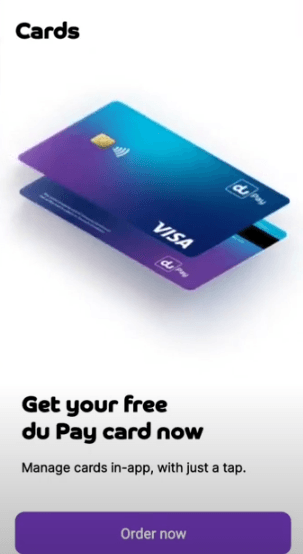

Get du Pay Card FREE (Limited Time)

du pay has started free cards to all new customers who create a new account in UAE. This is a limited-time offer and du pay is subject to the right to change the card policy/fee at the time. Here is a quick guide to ordering a free du pay debit card:

- Open the du Pay app and log in to your account

- Go to the “Card” section in the footer bar

- Order a new card for free!

- Once you have received this card, activate it use it for online payments, and withdraw from any ATM.

du Pay Transaction Limits

| Activity | Per Transaction Limit | Daily Limit | Add funds via UAE-issued Debit / Prepaid card |

|---|---|---|---|

| Add funds via Bank account | AED 25,000 | AED 25,000 | AED 25,000 |

| International money transfer | AED 25,000 | AED 25,000 | AED 25,000 |

| POS Purchase (Card) | AED 10,000 | AED 25,000 | AED 25,000 |

| Add funds via the Kiosk | AED 10,000 | AED 10,000 | AED 25,000 |

| Send money to UAE bank account | AED 10,000 | AED 10,000 | AED 25,000 |

| Bill payments | AED 10,000 | AED 10,000 | AED 25,000 |

| E-commerce Purchase (Card) | AED 2,500 | AED 5,000 | AED 15,000 |

| Send money to UAE mobile number | AED 5,000 | AED 5,000 | AED 25,000 |

| Receive money to du Pay account | AED 5,000 | AED 5,000 | AED 25,000 |

| Cardless cash withdrawal | AED 5,000 | AED 5,000 | AED 25,000 |

| E-commerce Purchase (Card) | AED 5,000 | AED 5,000 | AED 25,000 |

| ATM withdrawal (Card) | AED 5,000 | AED 5,000 | AED 25,000 |

You can increase the du pay limits by calling customer support at 80038729.

du Pay Transaction Fees

| Service | Description | Charges (AED) |

|---|---|---|

| International Money Transfer (IMT) | No charge if cash is not collected | Varies by country |

| IMT Cancellation | Cancel IMT if cash pickup is unclaimed | No charge if cash not collected |

| P2P Transfer | Send money to other du Pay accounts | No charge |

| Domestic Bank Transfer | Transfer within UAE | 2.00 deducted by the biller |

| du/Etisalat Recharges & Bill Payments | Mobile recharges, postpaid bills | No charge |

| Utility Payments (Salik, NOL, ADDC, AADC, Etihad) | Toll, transport, and utility bills | No charge |

| Ajman Sewerage | Utility bill payment | 3.00 deducted by the biller |

| FEWA | Utility bill payment | 3.00 deducted by biller |

| Dubai Police | Fine payment | No charge |

| Cash-out (Cardless) | Withdraw from Emirates NBD ATM | No charge |

| Physical Card Order | Order a du Pay physical card | 25.00 |

| Domestic Card Payments | Within UAE | No charge |

| International Card Payments | Outside UAE | Exchange rate-based fee |

| ATM Cash-out (with card) | Local or international | Bank charges apply |

| Digital Card Replacement | Replace digital card | 5.00 |

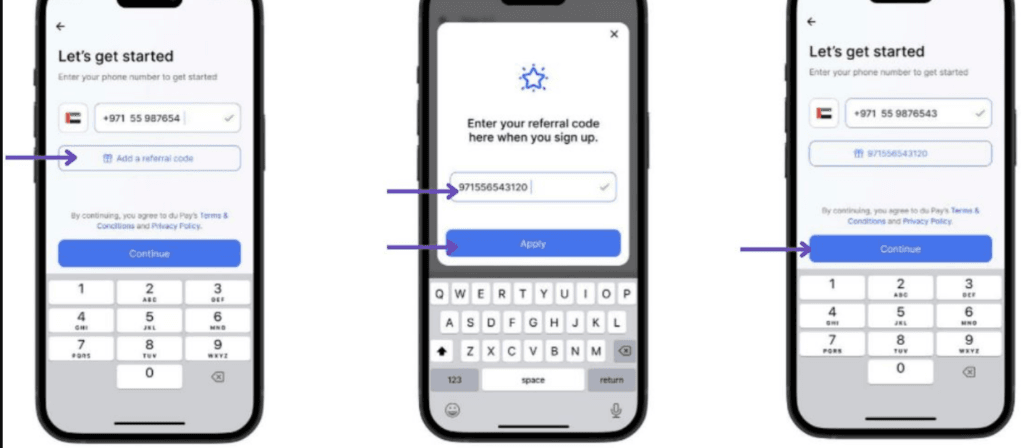

du Pay Promotions or Referal Code

Depending on DU’s promotions, you can get more than 10GB of data free. For this, you just have to enter the referral code while creating an account on DUPay, which will be the account number of a friend or loved one. While creating an account, DU asks you for this number, which you can skip, but doing so will not get you anything.

After creating an account you will be provided with some free data like this:

- 2GB data will be available upon successful account creation.

- 2 GB on account deposit

- Your account will get 2GB of data on every international fund transfer.

- 2 GB data on mobile recharge/DU bill payment

- If you create an account from your referral*, you will get 2GB of data each.

As per DU policy, this offer is only for DU prepaid customers. The data can be used for the next three days after being received.

You will need an Emirates ID or passport and a recent utility bill to verify your address and identity.

The account opening process is mostly completed in 15-30 minutes, including the verification stage.

There is no monthly fee to use du Pay. However, there may be a small fee for money transfers and certain services.

You can use your du Pay account to pay bills, top-up mobile, transfer money, and shop online.

Conclusion:

du Pay is a digital wallet that anyone with an Emirates ID can create and complete for free. Here we have explained the complete method of creating an account so that you do not face any problem. Only one du pay account can be opened in the name of a person.

If your mobile number is lost or you want to change your number, you can update it by going to the pay app. It’s the fastest and most modern way to send, receive, and pay bills in the United Arab Emirates. If you are facing any problems in creating an account, you can call the du Pay helpline.