On 20 October, both gold and silver prices in the UAE saw a minor decline, following global market trends and a slight shift in investor sentiment. Gold rates dipped slightly across all karat levels, while silver prices also saw a small drop per gram. Residents and expats monitoring the UAE precious metals market can use this update to make better buying or investing decisions. In addition to tracking precious metal prices, it’s essential for individuals to stay informed about financial regulations that could impact their investments. For instance, understanding the uae banks minimum balance rules can help potential investors manage their funds more effectively, ensuring that they meet necessary requirements while navigating the market. This awareness can ultimately lead to smarter financial decisions and enhance overall investment strategies.

This article breaks down the latest Dubai gold price movements and silver rate changes, with context on what’s driving the fluctuation.

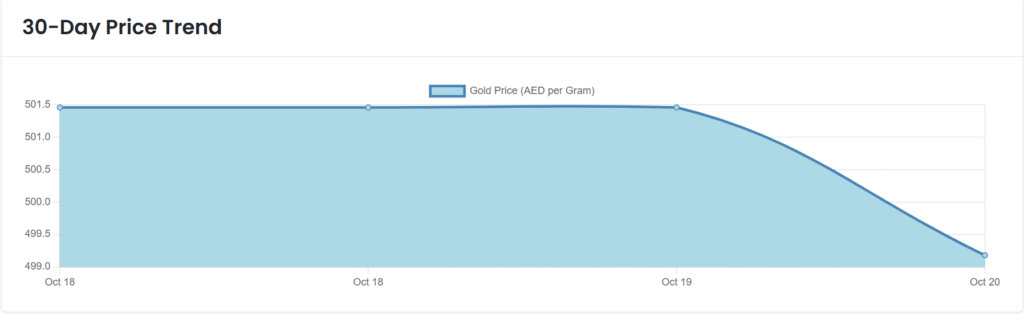

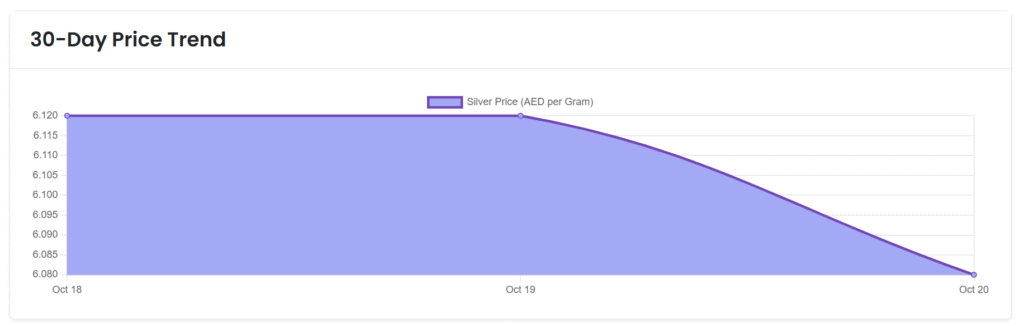

There has been a decline in the prices of silver and gold in the UAE. On October 18, 2025, the price of silver was AED 6.12 per gram, while on October 20, 2025, it was seen at AED 6.08 per gram. The gold prices mirrored this trend, with a noticeable drop observed within the same timeframe. Many investors and expatriates have been closely monitoring these fluctuations, as they can significantly impact financial planning and investments. Additionally, individuals seeking stronger financial management often turn to banking services for expats in UAE, which provide tailored solutions to navigate the local market landscape.

Similarly, the price of gold has reached AED 501.46 to AED 499.18, which has seen a decrease of about 2.28 dirhams. This decline in gold prices can have a significant impact on investors who rely on this precious metal as a safe-haven asset. As fluctuations continue, individuals may seek alternative financial tools in the UAE to diversify their portfolios and mitigate risks. Staying informed about market trends is crucial for making informed investment decisions in this environment. Investors should also consider evaluating their credit options as they navigate these market changes. Understanding how to find your credit score can empower individuals to make better financial decisions, especially when seeking loans or credit lines to support their investment strategies. By maintaining a strong credit profile, investors can access more favorable financing options, even during turbulent times in the gold market.

Gold price as of 20 October 2025

Looking for the most current Silver rate in the UAE? Today, October 20, 2025, the price is set at 6.08 AED per gram. The price per Tola, a popular unit in the region, is 70.92 AED. Market experts attribute the fluctuation in silver prices to various factors, including global economic indicators and local demand. Additionally, ongoing compliance measures such as the uae central bank aml crackdown are influencing market dynamics and investor sentiment in precious metals. Investors are advised to stay informed about these developments as they can significantly impact pricing trends. Additionally, changes in the emirates nbd remittance fee changes could further impact the local silver market as they may alter the cost of transferring funds for purchases. As international remittance fees fluctuate, they can influence the buying power of consumers and investors in the region. Keeping an eye on these financial adjustments is crucial for those engaging in precious metal investments.

- 1 Gram Silver — AED 6.08

- 1 Tola Silver — AED 70.92

- 1 Ounce Silver — AED 188.97

- 10 Tola Silver Bar — AED 709.16

- 1 Kilogram Silver — AED 6,080.00

Today’s Silver Rate in UAE 20 October 2025

As of October 20, 2025, the latest silver rate is AED 6.08 per gram.

- 1 Gram Silver: AED 6.08

- 1 Tola Silver: AED 70.92

- 1 Ounce Silver: AED 188.97

- 10 Tola Bar: AED 709.16

- 1 Kilogram Silver: AED 6,080.00

Remember that this fluctuation is in the market every day, so you can find out the gold price and silver prices here for complete details. In addition to tracking precious metal prices, it’s essential to stay informed about various financial services that can enhance your investment strategies. For those looking to streamline their transactions, understanding how to open du pay account can be beneficial. With the right tools and knowledge, managing your finances and investments becomes much more efficient. Additionally, it’s important to be aware of your insurance coverage and knowing how to check insurance status can provide peace of mind. Being proactive about your financial health will enable you to make informed decisions regarding your investments and safeguard your assets. By utilizing available resources, you can optimize your financial strategy and adapt to changing market conditions effectively.