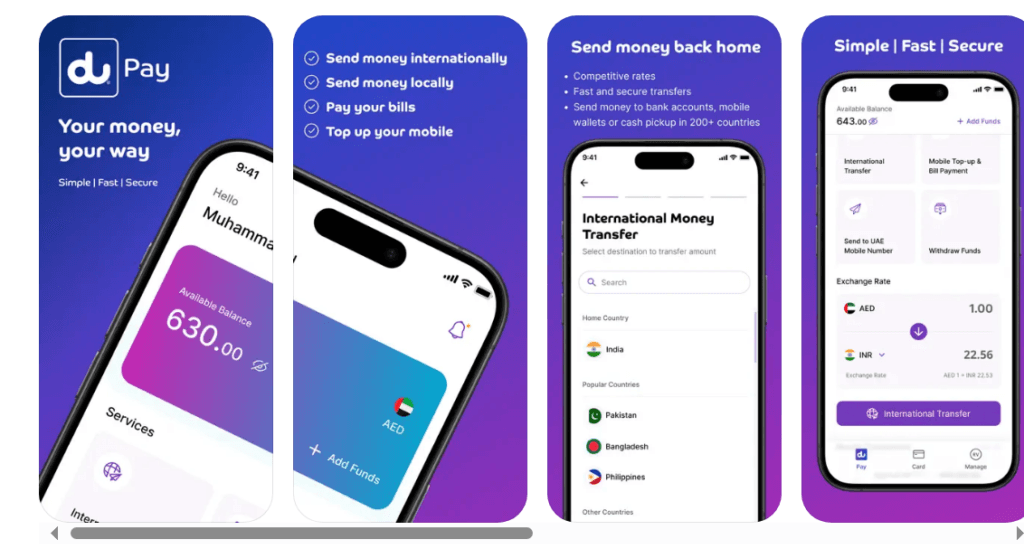

du Pay is a digital wallet app offered by du in the United Arab Emirates that works like a bank app. If you are unable to open a bank account in the United Arab Emirates, you can open a du Pay account quickly and easily from the comfort of your home. With this account, you can save money, pay bills, and send and receive money in more than 200 countries. Apart from this, duPay has many features like prepaid recharge, postpaid bill payment, tax payment government fee accrual, etc. In this article, we will learn how to create a du Pay account, the requirements, and its limits. In addition to its convenience, du Pay serves as an essential option for individuals seeking banking services for expats in UAE. This digital wallet not only simplifies financial transactions but also provides a robust alternative for those who may face challenges in accessing traditional banking facilities. As a user-friendly platform, du Pay empowers users to manage their finances seamlessly, making it an attractive choice for residents and newcomers alike.

Benefits of creating a du account:

- You can open it on any mobile network.

- There is no need for any kind of salary show-off.

- Open an account using the du Pay app quickly just using your Emirates ID

- Can send money to more than 200 countries

- Mobile recharge facility

- Modern Bill Payment Facility

- Paying government fees or taxes

- Shopping online

- You can use A physical credit card to withdraw money anywhere or shop online.

Also read: RPay Balance Enquiry

How to Open a Du Pay Bank Account Online in UAE?

You can follow the steps below to create a du Pay account:

1. Download and Install the du Pay app:

- First, you need to download and install the du Pay app. This app is available via Google Play Store or Apple Store.

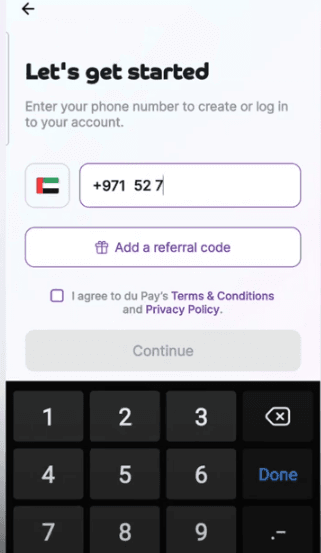

2. Register a new account

- Open the app, and go next to all the cards or options until the option to enter the mobile number appears in front of you.

- Enter your mobile number:

- In this step, you need to enter any mobile number of yours whether it is DU, Etisalat, or Virgin mobile network. Check the terms and conditions and click “Continue”.

One thing to remember is that this number should be registered in your name so that you don’t face any kind of problem later. Additionally, keeping your account information up to date will ensure that you can easily access your financial details. If you’re unsure about your current balance, it’s important to know how to check ratibi balance to manage your finances effectively. Being proactive about these details will help you avoid any unexpected issues down the line. Additionally, staying informed about market trends, such as the gold and silver prices update, can play a crucial role in your financial planning. Keeping an eye on these prices will help you make informed decisions about investments and purchases. Regularly monitoring these factors ensures that you remain financially savvy and prepared for any opportunities that may arise.

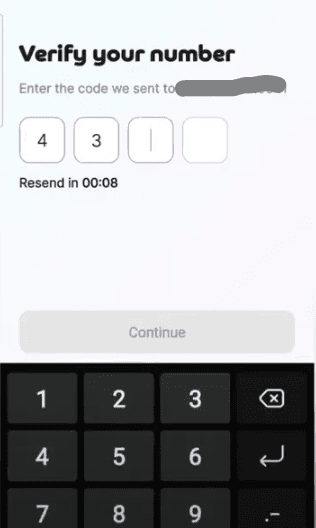

3. Verify your Number

- Verify your number by entering the received 4-digit OTP in the app. Click or tap on the “Continue” button.

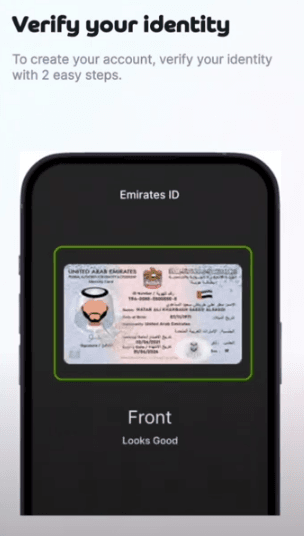

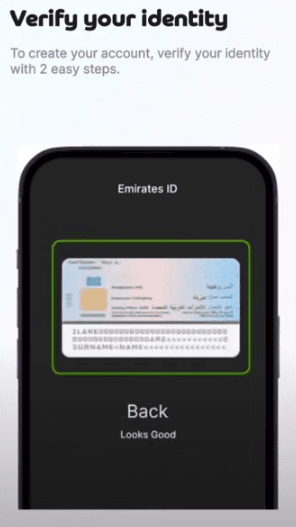

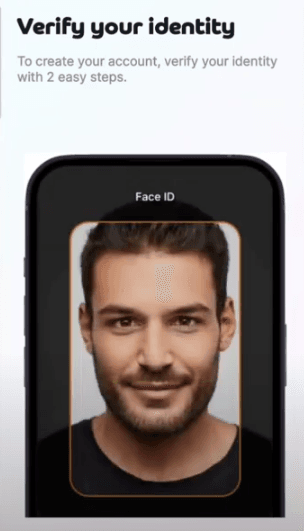

4. Verify your Identity

Now you will need verification for which you must have an Emirates ID.

- In the first step, you have to upload your Emirates ID front site.

- In the second step, you have to upload the back side.

- In the third step, du Pay will ask you for a selfie or live verification. Here you have to take your live selfie and verify it.

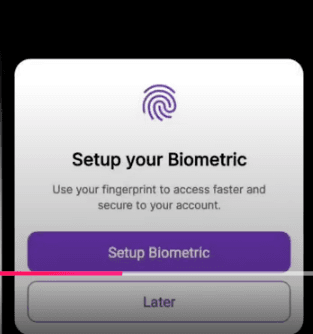

5. Setting Up Biomatric or PIN

After all the verification is done, DUPay will give you the option to set a PIN or lock your biometric. Click “Setup Biometric” if you want to set it up or click “Later” to skip it. Once you’ve chosen to set up your security features, you can also easily access your account details. For instance, if you’re interested in managing your finances, the lulu salary card balance check option allows you to keep track of your available funds effortlessly. This ensures that you stay informed and in control of your spending at all times. Additionally, DUPay provides insights into various financial tools and resources, enabling you to explore alternative investment options that can enhance your portfolio. By utilizing these features, you can make informed decisions that align with your financial goals. Staying updated on market trends and potential opportunities will further empower you to maximize your investments.

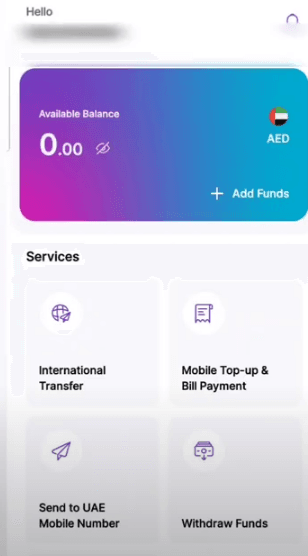

6. Start Using du Pay

Now your account is created and you can use it to send, receive, pay bills, and many other things. To transfer money to du Pay, you can transfer money from any nearby inward bank transfer or via a network of payment machines. You can also manage your finances more effectively by checking your balance regularly. If you’re a public transport user in the area, knowing how to check hafilat card balance can be helpful to ensure you always have enough funds available for your travel needs. Additionally, take advantage of the various features offered through your account for seamless payments and transfers. Moreover, if you want to check your account balance quickly, you can use the ppc fab bank balance inquiry feature, making it easier to stay on top of your finances. This ensures you are always aware of your available funds and can make informed spending decisions. Don’t forget to explore additional resources and tools provided by your bank to optimize your banking experience.

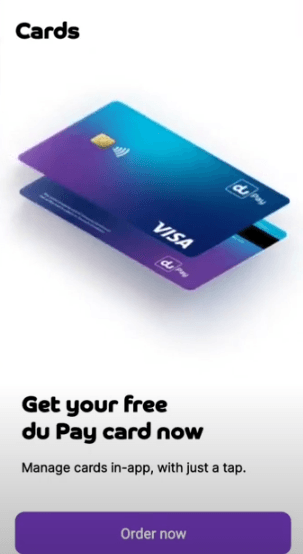

Get du Pay Card FREE (Limited Time)

du pay has started free cards to all new customers who create a new account in UAE. This is a limited-time offer and du pay is subject to the right to change the card policy/fee at the time. Here is a quick guide to ordering a free du pay debit card: To take advantage of this offer, simply follow the online application process and provide the required documentation. It’s also a great opportunity for those looking to open emirates nbd salary account, as linking it with your new du pay card can facilitate seamless transactions. Make sure to check for any additional promotions that may enhance your banking experience with du pay. Additionally, it’s important to stay informed about the latest policies from UAE banks, as many are implementing changes that may lead to a uae banks minimum balance increase. By keeping track of these updates, customers can better manage their finances and avoid any unexpected fees. Remember to review your banking options periodically to ensure you are benefiting from the best services available.

- Open the du Pay app and log in to your account

- Go to the “Card” section in the footer bar

- Order a new card for free!

- Once you have received this card, activate it use it for online payments, and withdraw from any ATM.

du Pay Transaction Limits

| Activity | Per Transaction Limit | Daily Limit | Add funds via UAE-issued Debit / Prepaid card |

|---|---|---|---|

| Add funds via Bank account | AED 25,000 | AED 25,000 | AED 25,000 |

| International money transfer | AED 25,000 | AED 25,000 | AED 25,000 |

| POS Purchase (Card) | AED 10,000 | AED 25,000 | AED 25,000 |

| Add funds via the Kiosk | AED 10,000 | AED 10,000 | AED 25,000 |

| Send money to UAE bank account | AED 10,000 | AED 10,000 | AED 25,000 |

| Bill payments | AED 10,000 | AED 10,000 | AED 25,000 |

| E-commerce Purchase (Card) | AED 2,500 | AED 5,000 | AED 15,000 |

| Send money to UAE mobile number | AED 5,000 | AED 5,000 | AED 25,000 |

| Receive money to du Pay account | AED 5,000 | AED 5,000 | AED 25,000 |

| Cardless cash withdrawal | AED 5,000 | AED 5,000 | AED 25,000 |

| E-commerce Purchase (Card) | AED 5,000 | AED 5,000 | AED 25,000 |

| ATM withdrawal (Card) | AED 5,000 | AED 5,000 | AED 25,000 |

You can increase the du pay limits by calling customer support at 80038729.

du Pay Transaction Fees

| Service | Description | Charges (AED) |

|---|---|---|

| International Money Transfer (IMT) | No charge if cash is not collected | Varies by country |

| IMT Cancellation | Cancel IMT if cash pickup is unclaimed | No charge if cash not collected |

| P2P Transfer | Send money to other du Pay accounts | No charge |

| Domestic Bank Transfer | Transfer within UAE | 2.00 deducted by the biller |

| du/Etisalat Recharges & Bill Payments | Mobile recharges, postpaid bills | No charge |

| Utility Payments (Salik, NOL, ADDC, AADC, Etihad) | Toll, transport, and utility bills | No charge |

| Ajman Sewerage | Utility bill payment | 3.00 deducted by the biller |

| FEWA | Utility bill payment | 3.00 deducted by biller |

| Dubai Police | Fine payment | No charge |

| Cash-out (Cardless) | Withdraw from Emirates NBD ATM | No charge |

| Physical Card Order | Order a du Pay physical card | 25.00 |

| Domestic Card Payments | Within UAE | No charge |

| International Card Payments | Outside UAE | Exchange rate-based fee |

| ATM Cash-out (with card) | Local or international | Bank charges apply |

| Digital Card Replacement | Replace digital card | 5.00 |

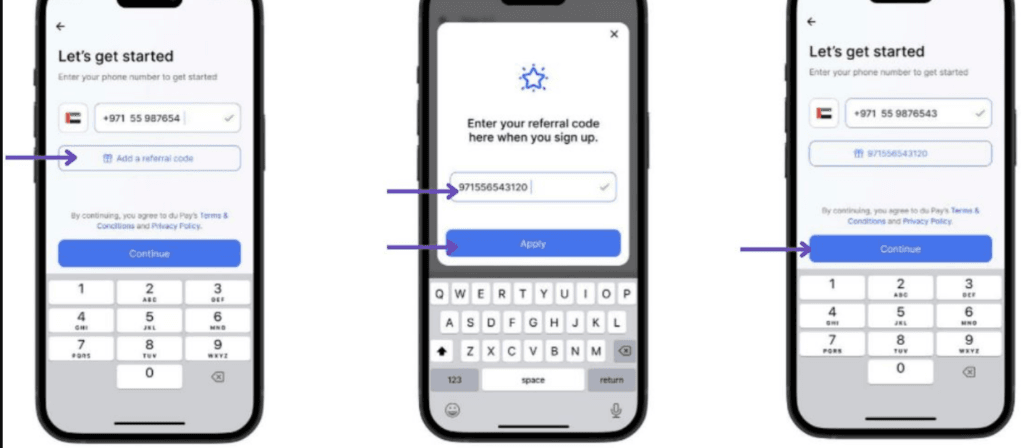

du Pay Promotions or Referal Code

Depending on DU’s promotions, you can get more than 10GB of data free. For this, you just have to enter the referral code while creating an account on DUPay, which will be the account number of a friend or loved one. While creating an account, DU asks you for this number, which you can skip, but doing so will not get you anything. Additionally, as the UAE Central Bank AML crackdown continues, it’s essential to ensure that your financial activities remain compliant and transparent. By taking advantage of promotions and referral codes, you not only maximize your benefits but also contribute to a safer financial environment. Remember, staying informed about these regulations helps you make the most of your services while adhering to legal standards.

After creating an account you will be provided with some free data like this:

- 2GB data will be available upon successful account creation.

- 2 GB on account deposit

- Your account will get 2GB of data on every international fund transfer.

- 2 GB data on mobile recharge/DU bill payment

- If you create an account from your referral*, you will get 2GB of data each.

As per DU policy, this offer is only for DU prepaid customers. The data can be used for the next three days after being received. Customers must also ensure they comply with the know your customer regulations in uae to successfully avail of this offer. Failure to meet these requirements may result in ineligibility for the promotion. Please check your account status and eligibility before attempting to redeem this offer. Moreover, customers are encouraged to explore other benefits available to them, including financial tools in the uae that can enhance their mobile experience. Staying informed about the latest offers and regulations will ensure that users make the most out of their DU prepaid plan. Remember, timely utilization of the data remains crucial to avoid any lapses in service.

You will need an Emirates ID or passport and a recent utility bill to verify your address and identity.

The account opening process is mostly completed in 15-30 minutes, including the verification stage.

There is no monthly fee to use du Pay. However, there may be a small fee for money transfers and certain services.

You can use your du Pay account to pay bills, top-up mobile, transfer money, and shop online.

Conclusion:

du Pay is a digital wallet that anyone with an Emirates ID can create and complete for free. Here we have explained the complete method of creating an account so that you do not face any problem. Only one du pay account can be opened in the name of a person. Once your du Pay account is set up, you can easily manage your transactions and link it to various services. However, if you ever find the need to switch to a different banking option, it’s important to know how to close a mashreq neo account properly to avoid any potential fees or complications. Ensure that any outstanding balances are settled before initiating the closure process. Additionally, as you explore various services linked to your du Pay account, it may be beneficial to learn how to check insurance status to ensure that you have adequate coverage. Staying informed about your insurance can prevent unexpected expenses in the future. Always keep your personal information updated to facilitate smooth transactions and correspondence with service providers.

If your mobile number is lost or you want to change your number, you can update it by going to the pay app. It’s the fastest and most modern way to send, receive, and pay bills in the United Arab Emirates. If you are facing any problems in creating an account, you can call the du Pay helpline. In addition, staying informed about your financial status is important, and one way to do that is to learn how to check credit score. This will help you monitor your credit health and make more informed financial decisions. For any further assistance or inquiries, the du Pay customer service team is readily available to support you. Additionally, it’s crucial to stay updated on any changes that may affect your transactions, such as the emirates nbd remittance fee changes. Understanding these fee adjustments can help you manage your finances more effectively and avoid unexpected charges. Regularly reviewing such updates ensures you are always making the best decisions regarding your money transfers.